Are you having a tough time finding a loan while living on benefits? This is because of the income insecurity factor. You do not earn via direct employment, and this could be a roadblock to getting loans.

You do not have to drain your savings as financial assistance from the Government is available. However, you will still be receiving less than what you were earning. This disparity between your earnings and expenses can result in missed payments.

This can further blemish your credit scores, which is not a great thing in your situation. Thus, a constant funding gap will exist, and you might need external funding to overcome it. Is it possible to get a loan with setbacks and the least obligations?

Yes, you can apply for loans for bad credit with no guarantor facility in the UK. These loans again come with an additional benefit in the form of relief from providing any guarantor. While some traditional lenders might ask you to arrange a guarantor, direct lenders can be an exception for you.

They empathise with your situation and get ready to offer loans. Nevertheless, they need assurance in the form of benefits that are treated as legitimate income sources. Besides, you must try to amplify your earnings by working part-time.

Delve deeper to analyse how a loan for people on benefits can come in handy during an emergency.

How a loan on benefits can help cover emergencies?

Government assistance cannot fulfil your necessities completely. You might have to dip into your savings to sail through the remaining expenses. However, this cannot continue forever as your cash reserve holds a limited amount of funds.

In that scenario, getting loans for people on benefits makes sense. These loans can help you bridge the funding gap and address some pressing payouts. They are a saviour when other financing options might not be available for you.

Ways these loans can provide you relief from cash problems

When you look for quick and flexible funding despite being dependent on benefits, these loans are your suitable option. This is because they have features that can benefit you in different ways. You are already in a traumatic situation, and these loans can lower your stress.

· Interest rates to be practical

Just because you are going through many disadvantages does not mean you are ineligible for other facilities. With these loans, you do not have to feel anxious about paying high interest. The loan provider will create a bespoke offer for you.

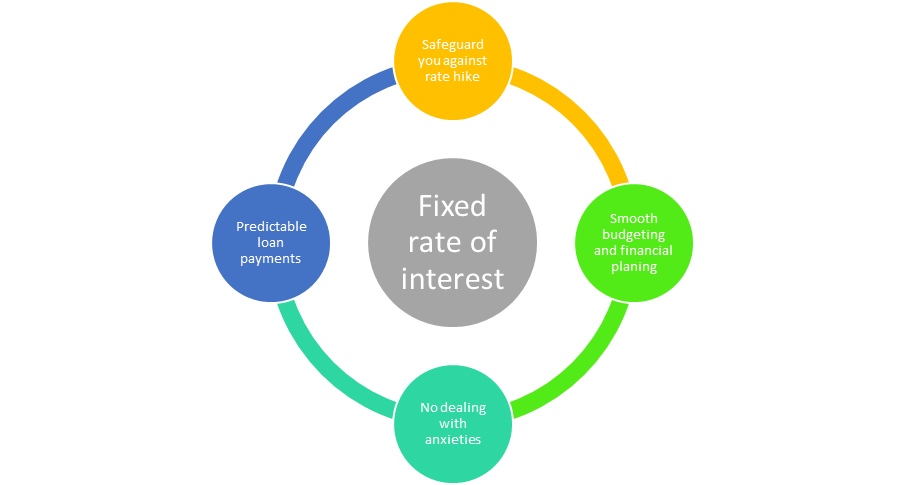

It reveals the interest rate that you can get based on the amount you want to borrow. The rate will be fixed and remain the same throughout the tenure of repayment. Now, this can provide you with surplus perks.

· Useful for any purpose

You will surely doubt if these loans can meet your necessities perfectly. Firstly, you get these loans despite having some flaws. Secondly, you do not have a stable source of income.

In this situation, you cannot think of getting an all-rounder loan. However, you are wrong, as these loans are ready to materialise for any of your genuine purposes. These could be:

Home improvement: Go ahead with urgent home refurbishment work by getting a suitable loan amount. You are free to get whatever amount is within your financial limit.

Medical bills: Medical emergencies should not be ignored even when you are living on benefits. Fetch the required loan amount to pay hospital bills or buy medicines as prescribed by the doctor.

Rent payments: Because of disability or loss of job, paying rent for a few months might be difficult for you. For the time being, you can get your hands on these loans to pay the rent.

Unexpected cost: You are going through a tough situation, and a sudden cash crunch can put you in the worst of conditions. No worries, even if you are not prepared for this. You can manage to get a suitable amount by applying for these loans.

· Enjoy speedy disbursal of loans

When you are dependent on external financial assistance, you run short on cash to tackle priority payments. Some expenses like buying food and groceries for the home are vital. You cannot let your family starve.

Getting a loan is meaningless if it cannot promise quick funding. The faster you can get money, the faster you can pay off these important payouts. These loans are obtainable from direct lenders who follow speedy steps to process the loan request.

One of the main reasons behind the delay in processing is documentation. This part is absent in the case of direct lending. This means you do not have to bother with putting up any paperwork.

All these enable the lender to make a decision about your application in a speedy manner. You can have funds transferred to your checking account in a short while.

· No-fuss application

There is no need for you to apply for loans by visiting the bank branch quite a few times. You can sit back at home and fill out the loan application. The loan form will enquire about a few details that concern your eligibility and requirements.

The application is accessible from a phone or laptop. You do not have to follow a specific schedule to apply for loans. This is because the loan website operates around the clock.

If you have any queries, you can approach the lender at any time. Likewise, you can submit the loan application at any time. In addition, you do not have to present a lot of details as they are not required in the pre-approval stage.

· Collateral is no longer needed

You will be surprised to know that the lender will not require any assets from your end. These are basically short-term funding, and your benefits will play a role in repayment assurance. Thus, collateral has no role to play as such.

The bottom line

Your financial life is not going to be smooth when you are living on benefits. Despite this, you can fight back with the help of loans and your savings. Keep trying to put together funds.

Mark Williams works as one of the Loan Advisors at a direct lender firm, Onestoploansolution. He has been working with the lender for about 15 years. He has been known to facilitate his employer in remarkable ways from writing to consulting and whatnot. He is a professional who wants to explore more of the UK financial market, the loan products and how customer requirement changes with time.