A lender analyses your credit history whenever you apply for a loan for personal or business purposes. It helps them understand the right loan amount to the lender and your affordability. Various parameters in your credit history, like- payment history, a mixture of debt, employment history, length, missed payments, and loan defaults, decides the credit score.

Credit agencies provide a number by basing these parameters. It is known as credit score. Different credit agencies like Equifax, Experian, and TransUnion provide credit scores and reports to a person. If your credit score is low, you may not receive the best deals for your needs.

What does a bad credit score imply?

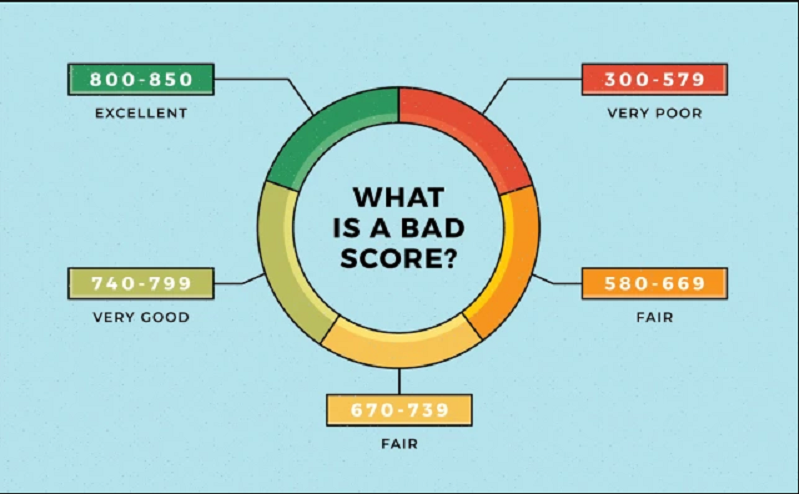

A bad credit score is a rating that reveals unmanaged finances, too many debts, low income, or no credit history. The lower the score is, the worse is the credit score. Credit agencies determine the number by analysing the report from various lenders.

According to Experian, if you have a credit score between 0-560, you have a bad credit score.

Though different credit agencies provide different numbers, it may not vary much. Experian is the most trusted one of all.

|

Credit score | Implication |

|

961-999 |

Excellent credit score |

|

881-960 |

Good credit score |

|

720-881 |

Fair credit score |

|

560-720 |

Poor credit score |

|

0-560 |

Very poor credit score |

What are some potential causes of a bad credit history?

No two credit reports are the same. There are ample reasons, like- missing a few repayments, which affect your credit score drastically. But let’s first know the primary cause of bad credit in the country.

As per the moneycharityorg. UK stats,

“Most people use credit to cover everyday living costs and increased cost of living are the primary reason for the debt.”

How does a poor credit score impact you?

Your credit score reflects how lenders see you as a loan applicant. If you have a bad credit score, you may face the following situations:

| Having a poor credit score implies that lenders may charge a high-interest rate on loans. Whether you apply for a credit card, payday loan, or car loan, you may get one at a competitive interest rate. It means you pay more than the one with a fair credit rating.

| You may face difficulty in getting a new job opportunity or a space to rent. The per-month payments would be high even if you get a rental space. Difficulty in getting a job may impact your rental payments. If you miss any, your credit score may drop further. |

|

If you lack both a good income and credit score, you may need to provide a guarantee in the form of a guarantor or collateralise the loan to qualify. It is especially when you need a higher loan amount despite low credit. | The insurance premiums on cars or other aspects may rise. Some insurance companies may cancel your agreement if your credit score falls below a certain level. It may impact your lifestyle goals drastically. |

How to fix bad credit history and reduce its aftereffects?

The good part about a credit score is – it does not remain fixed. You can ensure better it by taking some measures. Here are some ways how to improve your credit score:

1) Analyse discrepancies in your credit report

One should analyse the errors and debts in the credit report twice a month. It will help you budget for the payments and pay comfortably. Also, report any paid debt if it still reveals on your credit report.

2) Pay your rent timely

Schemes like Rental Exchange Initiative help private renters to boost their credit scores. It is an Experian scheme. The same source provides the reason,

“By working together, we have created The Rental Exchange to help tackle the challenges rental tenants face in the UK. Our initiative aims to tackle the financial, digital, and even social exclusion challenges that rental tenants often face compared to homeowners. By observing rental payment data like we view mortgage payment data, we can unlock a range of benefits for tenants, housing providers, and credit providers.”

If you pay rent to a landlord, Experian records it and boosts your credit history. For timely payments, reduce unnecessary costs and set an amount aside for monthly rental payments. Any tenant can join the scheme for free. You only need to provide banking details, personal details, and tenancy details.

Before renting any apartment, analyse the maintenance costs, rent, and align them will the income. If it impacts financial well-being, explore lower rentals.

3) Take a small credit and pay timely repayments

Individuals find themselves in a cash fix at the most inappropriate moment. Here, grab a quick loan instead of asking one of your friends or relatives for help. It is ideal for any emergency purposes. Once you qualify for it by providing employment details, make regular payments.

By doing so, you can witness your credit score changing. The lender reports this performance to credit bureaus, and you may get better rates later.

For example, if you need urgent cash to buy medicines but cannot wait until salary day, short-term loans like payday loans can help. You can borrow, suppose- £1000 for the medicines and buy them instantly. Pay the loan amount in easy monthly or weekly instalments. Consistent payments improve the credit score.

4) Reduce existing credit card balances

Credit card is a high-interest debt. Keeping an eye on your credit cards can help you raise your credit score. As per the CEO of Experian, James Jones “

“Keeping your card balances to no more than 30% of their limit, you can boost your credit score by 90 points.” He adds, “Lower credit card balances show lenders that you are not over-reliant on credit.”

Thus, ensure a 30:70 credit utilisation ratio. Do not request an additional credit limit unnecessarily. Avoid it if you have a bad credit history. It may impact your credit score.

5) Regular payments on council tax and subscription

As per a report by thesun.co.uk, –

“If you pay council tax and make regular payments on subscriptions like Netflix and other OTTs, you can boost your credit score by 101 points.”

To pay your subscription bill comfortably, use only those you visit often. Close down subscriptions that you do not visit even in 14 days. It implies you never will. Missing subscription payments also impact the credit score. Thus, classify and prioritise the one you use and pay regularly. It will help you ensure a significant credit boost.

What does a good credit score help with?

A good credit score helps you qualify for lower interest rates over a variety of lifestyle goals. It makes applying for credit cards and loans easier and quicker. Here are other benefits of a sound credit history.

You may qualify for loan applications for mortgage, car loan, car finance, home renovation, business loan, etc., at lower interest rates. The lender may agree to provide a higher amount or precisely the amount you need at a good credit score. | Good credit history grants you the ability to open new credit lines. It is beneficial for individuals who often shop and wish to benefit from discounted rewards, coupons, or travel cards. Nothing is better than timely discounts for the most awaited thing. |

| Eliminates any requirement to provide an additional personal guarantee with a guarantor or collateral. In this way, you can keep your finances secret and avoid staking your precious assets and belongings for a loan. | It helps you save money on a car, home, health, and other insurance coverage. Companies provide pocket-friendly premiums to individuals with responsible finances and good credit history. |

Thus, it clearly states the value of upkeeping a good credit score. Identify the elements affecting the score in your credit report periodically. If you need help knowing your finances better, contact an expert.

Bottom line

A credit score briefs your incomings, outgoings, and debt management. If you are sound with it, you may ensure a good credit score and qualify for better perks. The blog lists the causes and ways to improve the score in detail. It will help you build one from scratch and maintain it effortlessly.

Mark Williams works as one of the Loan Advisors at a direct lender firm, Onestoploansolution. He has been working with the lender for about 15 years. He has been known to facilitate his employer in remarkable ways from writing to consulting and whatnot. He is a professional who wants to explore more of the UK financial market, the loan products and how customer requirement changes with time.