Finding financing when your credit score falls under ideal levels can feel frustrating. Lenders see higher risk, even if you have a steady income to manage payments. However, there are still fair loan opportunities that are accessible even for imperfect applicant profiles.

This guide shares the easiest loan types to get approved for when credit histories have dings. We discuss alternatives suited best for your unique situation – some options leverage assets or co-signers to offset credit weakness for instance. Learn what bad credit lenders seek beyond just your score alone to say yes.

Don’t lose hope just because one lender denied your application! Spend time comparing multiple offers to find the right match based on rates, terms and qualifying factors.

Overview

| Loan Type | Rates | Trends |

| Secured Loans | Lower rates (5%-15%) due to collateral | Increasingly popular for large purchases like cars and homes |

| Payday Loans | Extremely high rates (200%-400%+ APR) | Scrutiny and regulation increasing; still widely used for emergencies |

| Credit Unions | Lower rates (6%-18%) compared to banks | Membership growing; seen as more community-oriented financial services |

| Online Lenders | Rates vary widely (6%-36%+) | Growth in fintech, use of alternative credit data |

| Borrowing from Family/Friends | Often zero or very low interest rates | Informal borrowing remains common for emergencies and personal needs |

| Co-Signed Loans | Lower rates (5%-20%) due to co-signers credit | Increasing use among those with a poor credit history |

Secured Loans

Secured loans require you to put up an asset like a car or property as backing for the loan. This lets lenders feel more confident approving loans with bad credit.

The amount of secured loans arranged between January and October of this year has already surpassed the entire number for last year by £6.8 million. This growth is attributed to the expansion of the second-charge loans sector to fill the gap left by mainstream lenders’ reluctance to lend.

Benefits

- Easier to qualify if you have assets but bad credit

- Chance at better rates than unsecured loans

- Build credit with on-time payments

Types

- Auto loans – Use the car as collateral

- Home equity loans – Use the home’s value as collateral

- CD/savings secured – Use savings account as collateral

Considerations

Do you have assets to put up? Are you ready to risk losing that collateral if payments become an issue? Make sure loan terms and rates still fit your situation. Secured lending opens doors when credit is limited, but consider carefully if it aligns with your financial goals.

Payday Loans

Payday loans give fast access to small amounts of cash, and the lenders approve without a credit check. You write a postdated check for the loan amount plus fees to be cashed on your next payday.

The Good:

- Fast application and funding process

- Available even with bad credit

- Low minimum credit scores

The Bad:

- Extremely high interest rates

- Fees take a major bite

- Must be repaid quickly

Who should consider them? Only those confident they can pay back the full loan plus all fees when due 2-4 weeks later. Otherwise, costs spiral out of control.

Consider more affordable personal loan options, borrowing from family and friends in a pinch, or services that offer access to earned wages early. Weigh payday loans carefully – while easy to get, the tradeoff of sky-high rates rarely ends well without prompt repayment.

Credit Unions

Credit unions are financial nonprofits, owned by members. They provide similar services as banks – savings/checking accounts, loans, and credit cards. Profits get returned to members in the form of better rates and lower fees.

Why choose them?

- Lower interest rates on loans

- Higher yields on savings

- Flexible qualifications

- Personal service

Local branches focus entirely on their community’s needs. National credit unions offer more locations, products and technology. The best fit depends on your priorities – relationships or convenience.

Who should join?

Almost anyone can become a member. If you value good service and supporting local businesses, a credit union likely aligns better with your values than big commercial banks. Unhappy with your current financial provider? Consider making the switch.

Online Lenders

Direct lenders provide loans with their own money. They handle the full borrowing process from start to finish. You only deal with one company for quicker service.

Good for Bad Credit

Direct lenders may approve those banks turned down. They can consider more than just scores in decisions. This helps people with bad credit get loans.

Fewer Middlemen

No brokers or agents are involved. This can result in lower rates for you through direct lender efficiency.

Debt Consolidation Option

Multiple debts can roll into one new loan with a single payment. You can easily get bad credit debt consolidation from direct lenders in the UK. This simplifies repayment and saves money on interest over time.

Compare Quotes

Rates still vary across direct lenders. Apply with several to find the best terms for your situation.

Borrowing from Family and Friends

Borrow cash from parents, siblings, grandparents and others in your circle. Since they know you well already, qualifying is easy.

Good Points

- No credit check or income proof is required

- Low rates or none at all

- Flexible repayment schedule

Watch Out For

- Strained relationships if payments fall behind

- Hard conversations about money with loved ones

Tips to Succeed

- Agree on clear loan terms upfront

- Keep communicating openly about finances

- Don’t borrow more than you can definitely payback

Great last resort if you have responsible family/friends able to help in rough times. All sides must set proper expectations first to maintain trust.

Co-Signed Loans

A co-signer signs the loan with you. This person must have good credit and income to increase your chances of qualifying. They promise to repay you if you can’t.

Applicants with weaker finances can use a co-signer with strong credit as a backup plan to get lenders to say yes. Your interest rate may even decrease. Sharing responsibility lowers risk.

Greater approval odds and better terms, even with bad credit or lack of proof of income. As long as the co-signer qualifies, you get the money.

They now bear equal responsibility! If your payments fall behind, the co-signer’s credit score takes a hit, too. Only co-sign for amounts you could fully afford yourself if needed. Don’t put finances in jeopardy.

Openly discuss any struggles to keep making payments on time. Signing up means showing faith in you, so don’t let loving family or friends down in a bind. Revisit modifying loan terms if hardships go on too long.

Co-signing is based on relationships and trust in one another. Make sure current struggles are temporary before linking a supporter’s finances to yours!

Conclusion

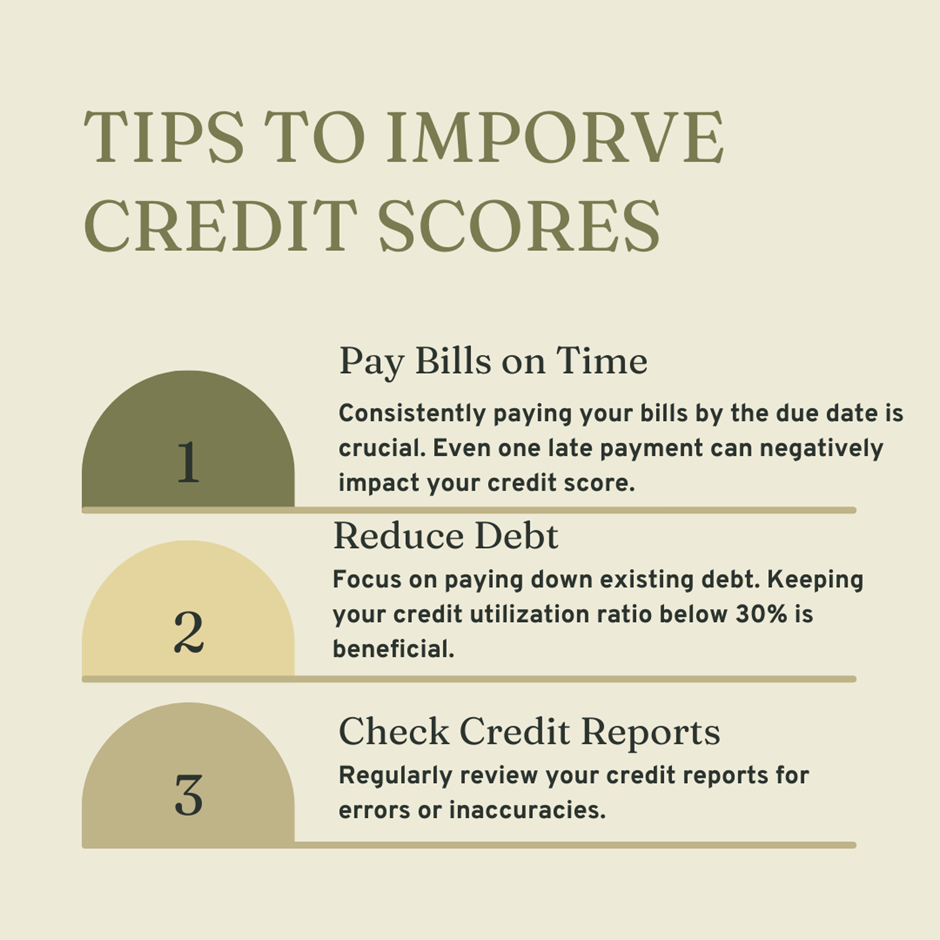

Even if your credit score is not great yet, options exist to get approved for loans. Certain lenders are more flexible on borrowing criteria. Doing good research prevents going with unfair terms out of frustration.

Some loans take advantage of desperate people through crazy high rates and junk fees. Avoid offers impossible to repay long-term. Only pick fair loan costs your budget can realistically manage.

Finding a lender willing to work with you despite dings allows rebuilding credit. Make all payments on time. Stay organised. Little responsible money habits over time positively reshape your financial reputation.

Mark Williams works as one of the Loan Advisors at a direct lender firm, Onestoploansolution. He has been working with the lender for about 15 years. He has been known to facilitate his employer in remarkable ways from writing to consulting and whatnot. He is a professional who wants to explore more of the UK financial market, the loan products and how customer requirement changes with time.